Omaha’s Urban Renaissance: Where Vision Meets Heart

Omaha is a gem in the heart of America's heartland. This historic railroad crossroads has transitioned into a vibrant urban hub, where old-world tradition meets modern innovation. The city's downtown renaissance exemplifies the power of collaborative vision, with public-private partnerships driving unprecedented growth and cultural vitality. Through strategic alliances between city leadership, corporate stakeholders, and philanthropic powerhouses like the Peter Kiewit Foundation and the Suzanne & Walter Scott Foundation, Omaha has masterfully leveraged its community-minded spirit to fuel development.

The result is a vibrant, lively downtown shining, from the historic cobblestone streets at the Market to the cutting-edge Capitol District entertainment area. The Downtown evolution represents what's possible when civic leaders’ vision aligns with philanthropic action, creating a model of urban development that many similar-sized cities across America look to emulate.

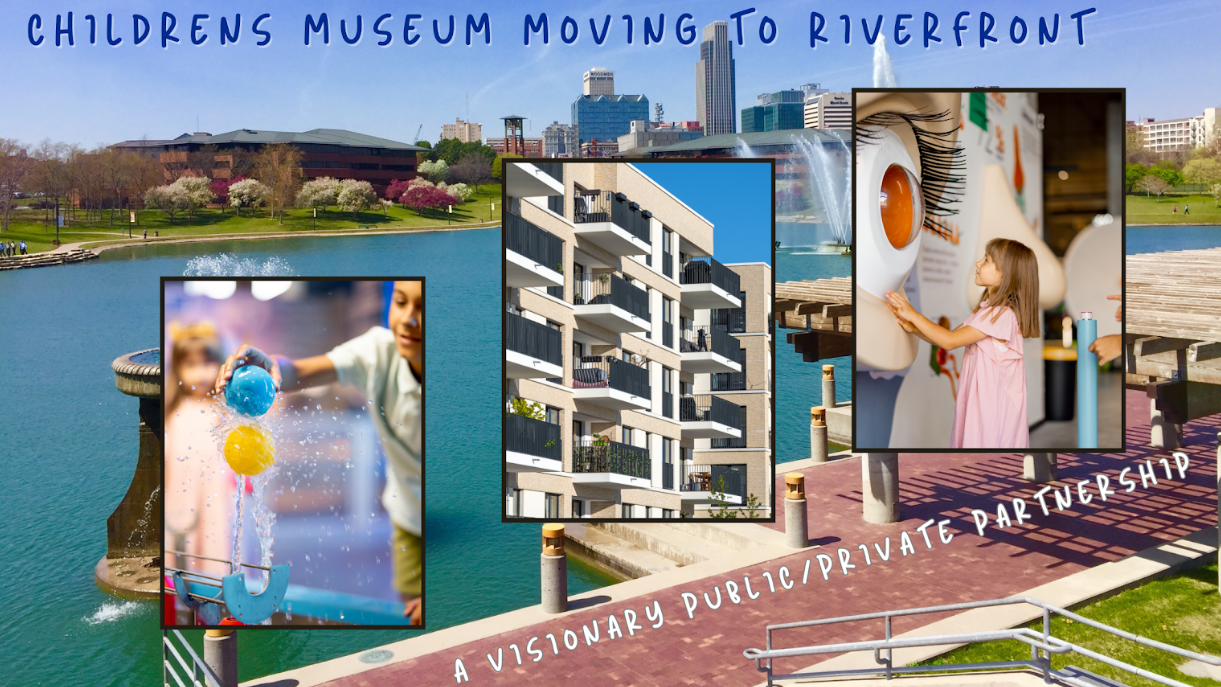

The latest example is the Children's Museum’s planned move to the Riverfront. Omaha Children’s Museum has created a 50-year legacy of serving children throughout Omaha. A partnership between the City of Omaha, NuStyle Development, and the Omaha Children’s Museum will introduce new residents, learning and leisure opportunities for Omaha’s riverfront. This latest unique development continues the momentum and growth in Omaha. This partnership brings together philanthropy, non-profit, private development, and the City of Omaha to deliver excellent public benefits.

The city chose city-owned property at a great location for this project. The city property is located on the north side of Douglas Street and borders Heartland of America Park. The estimated site development and parking ramp cost is approximately $36 million; the city will contribute $26 million. The Beam, a 16-story building at 8th and Douglas, will be built by NuStyle Development next to the new Omaha Children’s Museum. NuStyle plans to invest $87 million in the project. The Beam offers 261 one and two-bedroom apartments.

What will this new Riverfront vision look like? A 12-story wood-timber apartment building will be built on top of a four-story public parking garage, anchoring the combined museum/apartment development. The City of Omaha will build and operate the two parking garages and a surface lot with approximately 600 stalls available for public use, museum patrons, and tenants.

This property would never have been developed without the vision of our city leaders, Omaha’s’ Children Museum leadership, and the partnership with NuStyle.

The museum will not just be moving. Omaha Children’s Museum leaders plan to Create a dynamic new Museum with a unique new building, exhibits, and programming that create joy, generate curiosity, and foster connection. Museum leadership will leverage knowledge from some of the nation’s leading early childhood development experts based here in Omaha to create the master plan for the new museum.

The redevelopment agreements with NuStyle and Omaha Children’s Museum are expected to go to the Planning Board in November and the City Council in December.

Omaha Children’s Museum will continue to operate at its current location at 20th and Howard Streets during the fundraising for and construction of the new space, to transition to its new home in late 2027.

Be part of Omaha's extraordinary journey and discover your place in our thriving community.

Whether you're seeking a downtown loft with skyline views or looking to invest in the next up-and-coming neighborhood, the Heim-Berg Team brings unparalleled expertise to your real estate journey. Contact the Heim-Berg Team, Omaha's Real Estate Experts, at 402-677-9024 or visit www.OmahaAreaLiving.com to explore the possibilities that await in our dynamic city.

Are you ready for Omaha's Sweetest Halloween Celebrations and a weekend filled with smiles, giggles, and no scares? Enjoy all the family-friendly events around town, from costume parades to decorating pumpkins. The Heim-Berg team has collected some of the most delightful, not scary, events that will put smiles on your little goblins' faces. So, grab your trick-or-treating buckets, dress up in your best costumes, sprinkle on a little Omaha magic, and get ready to make awesome family memories. No tricks here – just plenty of treats and good old-fashioned fun! Some popular family-friendly events for good old-fashioned fun include:

Are you ready for Omaha's Sweetest Halloween Celebrations and a weekend filled with smiles, giggles, and no scares? Enjoy all the family-friendly events around town, from costume parades to decorating pumpkins. The Heim-Berg team has collected some of the most delightful, not scary, events that will put smiles on your little goblins' faces. So, grab your trick-or-treating buckets, dress up in your best costumes, sprinkle on a little Omaha magic, and get ready to make awesome family memories. No tricks here – just plenty of treats and good old-fashioned fun! Some popular family-friendly events for good old-fashioned fun include: