Omaha's Easter EGGstravaganza Weekend

Easter weekend is upon us, and that means family fun for everyone. Kids are getting excited for the surprises the Easter Bunny will bring, parents are ready for family time and good food, and everyone can't wait to see what the Easter eggs have in store for them. The question is, where do you celebrate?

Easter weekend is upon us, and that means family fun for everyone. Kids are getting excited for the surprises the Easter Bunny will bring, parents are ready for family time and good food, and everyone can't wait to see what the Easter eggs have in store for them. The question is, where do you celebrate?

Lauritzen Gardens is the perfect place to spend the entire Easter Weekend with the family.

Saturday April 15, 2017

Families can come and enjoy Easter egg hunts for all ages! But wait... that's not where the Extravaganza stops! You can snap an eggcelent photo with the Easter Bunny and create beautiful crafts with the family.

The Easter Extravaganza is from 9:00 AM - 12:00 PM. The crafts will be available from 9:00-11:00 AM and Easter egg hunts for ages 2 - 12 years old will be at 10:00 AM, 10:30 AM, 11:00 AM, and 11:30 AM. If your child is below 2 years old there will be a separate area designated for them to enjoy Easter egg hunts as well. The Easter Bunny is on site all morning (bring your camera) !

The Easter Extravaganza is from 9:00 AM - 12:00 PM. The crafts will be available from 9:00-11:00 AM and Easter egg hunts for ages 2 - 12 years old will be at 10:00 AM, 10:30 AM, 11:00 AM, and 11:30 AM. If your child is below 2 years old there will be a separate area designated for them to enjoy Easter egg hunts as well. The Easter Bunny is on site all morning (bring your camera) !

The cafe opens on-site at 9:00 AM and will have coffee, beverages, and breakfast to tide your hunger while you enjoy your time.

Registration is required before the event which can be done here or call (402) 346-4002, ext. 262 by 5:00 PM Wednesday, April 12. Standard garden admission rates apply, members are free. A charge of $3 per child will be required to participate in the crafts and Easter egg hunt.

Sunday, April 16, 2017

The fun continues Easter morning with the Garden's Easter Brunch. This annual tradition is a beautiful setting among the Garden's flowers and sells out quickly. The cost is $30 per person, $13 for kids 6-12 and children 5 and younger are free. Reservations are required and along with payment up front. The menu selection is available here.

For reservations and information please contact Merri at (402) 346-4002 ext. 201 or email at [email protected] by Wednesday, April 12.

With over 13 magnificent hand-built displays, these larger than life sculptures show the web of connections that nature sustains in everyday life. Kids can gaze as the wingspan of a monarch butterfly, see the colorful display of the peacock’s tail, or hang with the buck and his deer.

With over 13 magnificent hand-built displays, these larger than life sculptures show the web of connections that nature sustains in everyday life. Kids can gaze as the wingspan of a monarch butterfly, see the colorful display of the peacock’s tail, or hang with the buck and his deer.  Lace up those running shoes and get ready for the

Lace up those running shoes and get ready for the

For three days film makers of all sorts are able to feature their videos, commercial, educational films and much more to open the eyes and hearts of those who have not had the opportunity to truly enjoy horses from their point of view. The

For three days film makers of all sorts are able to feature their videos, commercial, educational films and much more to open the eyes and hearts of those who have not had the opportunity to truly enjoy horses from their point of view. The

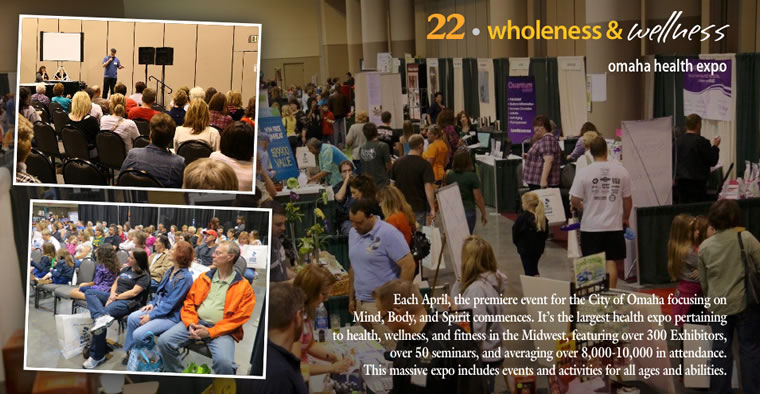

This event is the largest in the region and is held on Saturday April 8 & Sunday April 9, 2017. From seminars to booths, you can learn how to live a healthier, happier lifestyle and create habits you can incorporate into your every day routines.

This event is the largest in the region and is held on Saturday April 8 & Sunday April 9, 2017. From seminars to booths, you can learn how to live a healthier, happier lifestyle and create habits you can incorporate into your every day routines.